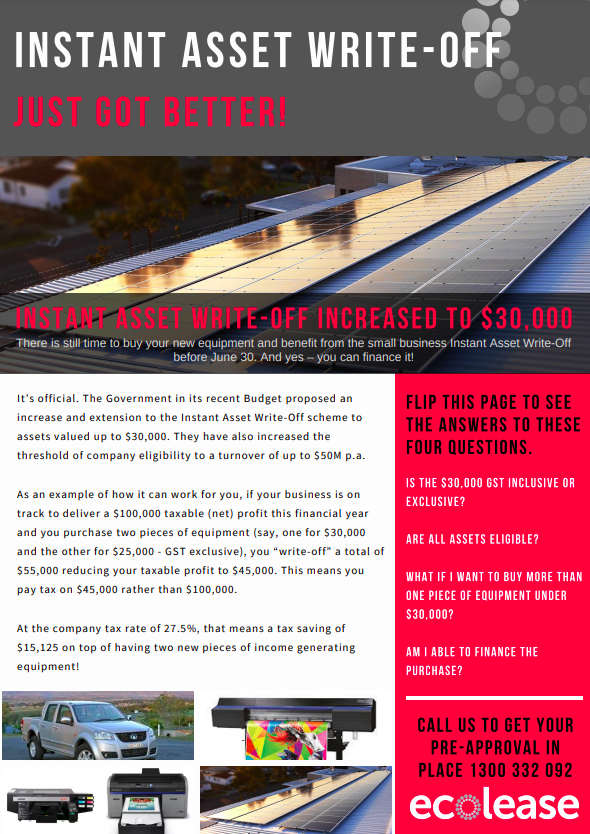

INSTANT ASSET WRITE-OFF INCREASED TO $30,000

There is still time to buy your new equipment and benefit from the small business Instant Asset Write-Off before June 30. And yes – you can finance it!

It’s official:

The Government in its Budget proposed an increase and extension to the Instant Asset Write-Off scheme to assets valued up to a threshold of $30,000, and increased the threshold of company eligibility to a turnover of up to $50M p.a.

What does this mean and how does it work?

If you acquire and install a new or used asset between April 2 2019 and June 30 2019 of $30,000 or less you can instantly write-off the TOTAL asset value this financial year.

For example, if your business is on track to deliver a $100,000 taxable (net) profit this financial year and you purchase two pieces of equipment, say one for $30,000 and the other for $25,000 (GST exclusive), you write-off a total of $55,000 reducing your taxable profit to $45,000. This means you pay tax on $45,000 rather than $100,000.

At the company tax rate of 27.5%, that means a tax saving of $15,125 on top of having two new pieces of income generating equipment!

Additional Instant Asset Write-Offs:

- For businesses with turnover of $10 million, you can instantly write-off the asset value of new and used equipment costing $25,000 or less, if it was acquired and installed for use between 29 January and 1 April 2019. **Yet to be legislated.

- For businesses with turnover of $10 million, you can instantly write-off the asset value of new and used equipment costing $20,000 or less, if it was acquired and installed for use between 1 July 2016 and 29 January 2019.

How does the finance fit in with it?

To finance your equipment and still qualify for the Instant Asset Write-Off, you need to use a Chattel Mortgage/ Specific Security agreement. We recommend you get a finance pre-approval in place before you go looking for your new equipment.

Other questions:

Is the $20,000, $25,000 and $30,000 GST inclusive or exclusive?

If the entity is registered for GST, then the GST exclusive amount is taken to be the cost of the asset.

Where the entity is not registered for GST, then the GST inclusive amount is taken to be the cost of the asset.

Are all assets eligible?

All assets (including new and second hand) will be eligible, except for a small number of exclusions which receive different depreciation treatment. Your accountant should be able to advise you.

For more information please get in touch with our team on 1300 322 092, or you can also ring the ATO direct for more details 13 28 66.

Disclaimer: The information contained here is published by Ecolease and whilst accurate at the time of publication may not have being passed in law as legislation and is not offered as advice in any way. Before you make any decisions on purchasing any asset you should consult your accountant or tax agent for further information regarding the Instant Asset write off scheme, you can also ring the ATO direct for more details 13 28 66.

[button type=”flat” shape=”rounded” size=”medium” href=”https://ecolease.com.au/wp-content/uploads/2019/05/Instant-Asset-Write-Off-9.pdf” target=”blank” title=”Download a Copy”][icon type=”download”]Download Brochure [/button]