1. The Four C’s of Credit

INTRODUCING THE FOUR C’S

Ever wondered why the banks and finance companies ask for the things they do when assessing your finance application?

At Ecolease, we live and breathe small business finance. Our role is to pull together your finance application, like joining the pieces of a puzzle, and presenting it in a clear and concise manner to our lenders to ensure a successful outcome.

No matter how big or small, or whether we use your financials or not to get your finance approved, there is a framework that lenders apply when deciding whether or not they are going to part with their cash and invest in you. It’s called the 4 C’s of Credit.

So next time you are applying for finance the summary below may explain the rationale behind what we may be asking you for.

In Summary the 4 C’s:

1. Character: It’s about who you are, your reputation and integrity when it comes to repaying a loan

2. Collateral: What is the asset being financed and what’s it’s value now, and in the future

3. Capital: This is about your financial position and any funds you have behind you and in your business

4. Capacity: Is all about the numbers and ensuring you have the ability to repay the loan

READ MORE…

Character

Before lending, banks and finance companies want to know who they are lending to. This is all about your reputation, integrity and willingness to repay debt.

The things lenders consider include your credit history (past loans and repayments), your savings history, and general stability (for example the length of time you have been in business). There is a much bigger focus on your credit history these days and the new positive credit reporting system (more about this later in another 3 Things Edition).

Collateral

Collateral refers to the type of asset that is being financed (property, land, equipment, vehicle). It’s what helps secures the loan.

For example, in equipment finance, lenders rate Cars, Trucks and Yellow goods (such as forklifts) very highly. This is because there is a good second hand market and these assets hold their value well (particularly yellow goods). So, if things were to go bad, the lender can quickly sell the asset and recoup some of their cost.

Capital

Even if you’re not offering them as collateral, having cash or assets within your business & personally provides lenders with some level of comfort that even if the worst happens, you will be able to draw on them if needed. It also is an indication of your business profitability over time and also your savings history.

Capacity

Also known as serviceability, this is perhaps the most important factor of all in assessing your loan application; whether or not you’ll have enough money available to cover your repayments.

To assess this, the lender will look at your business profits and cash flow projections, as well as your regular expenses (rent, wages, insurances, utilities, etc.) and any other existing obligations such as vehicle or equipment finance.

There are a number of finance options where we don’t need to go through this process, and this is where we can help you work through your options.

2. HUGE savings to be had on your energy bills

A SIMPLE FORMULA

At Ecolease we have helped various clients to save on their energy costs through financing solar power installations, irrespective of whether the premises are leased or owned.

Most clients, once they have installed solar, find that the savings they make on their energy bills more than offset the cost of the installation and is cash flow positive.

Here’s a simple way to look at how savings can be achieved and whilst not specific to every business provides a guideline.

- Most SME businesses in all likelihood require no more than a 30KW solar system

- A 30KW system generates about 120KWh of power a day, on average over a year.

- Approximately this could provide about $2,000 per month in power cost savings if the power is self consumed.

OK, so far so good, but how much is the installation and what are the financing costs? - Our experience tells us that the cost of installation equates to approximately $1,000 per KW of solar generation installed, so a 30KW system would cost approximately $30,000 (net of the STC discount that most installers would apply at time of quoting).

- The cost of financing a 30KW system installation would be approximately $600 a month (depending of course on length of term).

So, in this scenario, add $600 a month to operating costs and save approximately $2,000 a month in power costs, a net cash positive outcome of $1,400 a month which increases at the end of the finance term as the loan is paid out and in all likelihood power costs generally increase (solar panels have a shelf life of around 25 years).

Please note the above is an example based on industry averages and our own experience but here’s what one of clients had to say who installed solar.

3. Nationally, property values continued their recovery in August

If you are thinking of buying or re-financing property, is now a good time?

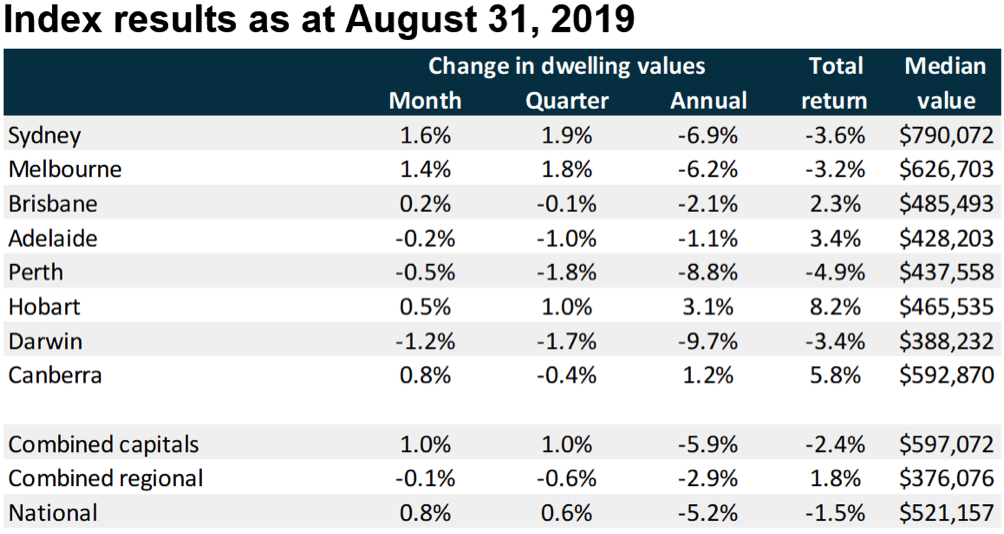

Home values increased by 0.8% in August this year with housing values in five of the eight capitals increasing and over the last quarter the national change in home values has seen an increase of 0.6%.

This recent growth appears to be a continuation of the trend throughout the year where value falls have been losing momentum and have now started to rise according to property market analytics source Core Logic.

As can be seen by the below index, the national change in values across all areas on an annual basis is still -5.2% but the trend appears to show that property prices are recovering consistently and as we begin to enter the property Spring sales season, if you are considering buying and or refinancing, now is a good time to start the planning process and Ecolease can help.

We can advise you of the sort of information you will need to show in your financials and identify the best structure for your loan according to your circumstances.