1. Need new kit?

Here’s a strategy to offsetting the loan cost through installing energy saving technology!

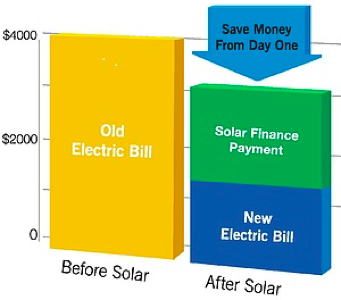

If you haven’t already installed or thought about Solar to reduce your energy bill costs, you really should. In many cases the smaller energy bill plus the cost of financing the energy saving technology is less than the old electricity bill, leaving you with some extra cash that could be put towards funding that new piece of equipment you’ve been wanting.

“The payback period is very short and we are on track to achieve two thirds cost saving per annum.

Peter Anargyros, Managing Director, Created to Print, Adelaide

Our business has two buildings and we wanted solar panel installations put on both and our reduction in energy costs is around 70% p.a since the system was turned on.

The Sign and Badge Centre Bayswater, Victoria.

So remember, the Sun will never send you an invoice!

Whether you own or lease your premises, Ecolease can help finance your installation and we even have our own Solar expert consultant who can assist evaluate the likely savings you can make with solar for free, so if you would like a free evaluation contact us now.

2. Thinking new car?

MAKE SURE YOUR COMPARING AN APPLES WITH APPLES QUOTE

When can an interest rate of 5.5% mean lower monthly repayments than another quoted interest rate of 2.99% when they both have the same loan period and payout balances?

Simple really, at Ecolease we always quote the effective rate not the base rate. The effective rate reflects the true cost of the loan, including all interest and fees, and provides you with a true comparison against other financing options. We like to call it our Apples with Apples quote!

The base rate, on the other hand, is often quoted to entice people. It is the net rate BEFORE any costs and fees have been amortised into the loan. It’s for this reason, we often get asked:

“How come your repayments are lower, yet your interest rate is higher?“

The best way to get around this, is to always ask for a quote to include the repayments and terms, rather than asking just for an interest rate.

Based on a competitve effective rate of 5.5%, the following repayments apply:

New car cost: Monthly repayments:*

$50,000 $806 per month

$75,000 $1209 per month

$100,000 $1612 per month

*Monthly in advance based on 60 month term with a 20% balloon

So next time you are looking to buy a new car use this as a guide and always make sure you ask for what THE EFFECTIVE RATE is and check with us first to make sure you are comparing Apples with Apples.

3. How healthy is your business?

End of calendar year, when business is typically quieter, can be a good time to reflect on how your business is performing. Here are four key ratios that can help you understand better how healthy your business really is.

1. Revenue KPI the EBIT margin ratio

Every one of us in business knows what our Gross profit ratio is but the EBIT (earnings before interest or tax) margin ratio is a percentage that shows you how much you earn after deducting all expenses.

Formula:

Revenue – Cost Of Goods Sold (COGS) – Op expenses = EBIT

Example:

$1,000,000 in revenue

$500,000 is the COGS

$250,000 all other expenses

$1,000,000 – $500,000 – $250,000 = $250,000 which is 25% of revenue

A 25% profit margin, meaning twenty five cents of each sales dollar is remaining for your business. The other 75% of earnings go toward expenses.

Most businesses aim for having margins above 25% but standards vary with different industries

2. Liquidity KPI the Acid Test Ratio

The Acid Test Ratio (sometimes called the Quick Test) is used to measure short-term liquidity. Liquidity is your business’s ability to pay off current liabilities (debts you must pay off within 12 months) with current assets (items your business has that can easily be converted into cash within 12 months), not including inventory.

Formula:

Cash + Marketable Securities + Accounts Receivable ÷ by current liabilities

Example:

You have $8,000 in cash,

$0 in marketable securities,

$3,000 in accounts receivable.

$4,000 in current liabilities,

$8,000 + $0 + $3,000 ÷ $4,000 = 2.75

Your Acid Test Ratio is 2.75. This shows that you have $2.75 in assets per $1.00 of liabilities, which means you have enough to meet financial obligations.

A quick ratio of 1.0 or more means you are able to meet your financial obligations. 1.0 means that you have $1.00 in liquid assets per $1.00 of current liabilities. If you have a score below 1.0 it means you are unable to pay all your liabilities.

3. Investment KPI the ROI (Return On Investment) Ratio

The ROI Ratio shows you how much your company gained from an investment you made. ROI is a percentage and helps you determine which investments were successful and which weren’t.

Formula:

Net gain from Investment ÷ by cost of Investment X 100

Example:

Le’s say you want to measure the ROI of your marketing strategy. You have $9,000 in gain from investing in say Google Adwords advertising, and your cost of investment was $5,000:

Net gain $4,000 ÷ $5,000 = 0.8 x100 = 80%

In this example, you made a good marketing investment since 80% is high.

4. Cash Flow KPI the Debtor Day Ratio

This is a ratio that measures how efficiently a business is collecting receivables.

Formula:

Average trade receivables ÷ annual credit sales X 365 days

Example:

A company has average trade receivables of $2,000,000 and annual sales of $15,000,000

$2,000,000 ÷ $15,000,000 X 365 = 48.66 meaning that its average Debtor Day Ratio is 48.66 days.

There are a number of ways to reduce debtor days. A key one is by having credit policies and procedures in place, including taking steps to approve customers before granting payment terms, having clear invoicing procedures and following up quickly when invoices are overdue.