1. I didn’t know you were into that!”

YES…we can help you finance the whole Kit and the Kaboodle.

On a recent interstate business trip I was surprised to hear on a number of occasions the words I didn’t realise, which were usually followed by words like you financed equipment that cost over $500,000 or you did property finance, or you were into solar financing.

Well, here at Ecolease we do because we are very diversified in what we can finance in terms of type of equipment, type of property, type of vehicle AND the value of the asset.

Here are some examples:

- in property a client wanted to finance the purchase of a farm in Cowra for over 2.5 million dollars, we did it.

- another client needed to finance a specific Mezzanine level in a warehouse for 250k, we did it.

- in equipment a client wanted to purchase two Turf Harvesters at a cost of 700k, we did it,

- another client needed a flatbed printer and cutter at a value of 500k, we did it,

- and a customer’s 50th birthday we helped finance a 1967 Mercedes 250SL, for 160k, the car was made the year he was born.

For equipment in Manufacturing, Hospitality, Printing or just about any category, if you need it, we can help finance it.

For property, whether it’s Commercial, Industrial, Residential, Regional, Rural, or a Farm, we can help finance it.

For vehicle whether it’s a Tractor, a UTE or a Luxury Car, we can help finance it.

And, whether it’s an asset that is worth $5,000 or $5,000,000, we can help finance it.

So, don’t hesitate to let us know.

2. The bullet that got dodged

The final recommendations from the Banking Royal Commission.

Whether it is big or small finance you are after, it pays to work with someone that knows your business in this Post Bank Royal Commission world. Relationships with people that know you, your business and your industry are more critical than ever, to ensure finance success.

Why so?

Although the commission has recommended that there be no further regulation applied to the Small Business finance sector (i.e. Commercial), lenders are in conservative mode when it comes to assessing business finance applications.

If we wind it back 9 years, the commercial lending space dodged a bullet when the world was rewriting how banks should be assessing loans for individuals (such as Home Loans). At that time, the National Consumer Credit Protection Act (NCCP) was passed and the term Responsible Lending became critical in the banking sector.

The laws were put in place to protect individuals from unethical lending practices and placed much more onus on the lenders to ENSURE the borrower could repay the debt. Information that needs to be collected from and also supplied to the borrower has become quite onerous. Despite its irrelevance in the commercial sector, some politicians wanted to drag small business finance under the NCCP Act and each year since. The consequences would have been disastrous for small business access to finance, and the economy at large. Commissioner Hayne has largely put this to bed and we sigh with relief.

Yet still, the banks are nervous and don’t want to be pointed out as doing the wrong thing. Working with someone that knows your business has never been more crucial to work through these issues and present your business in the best possible light to lenders.

So, don’t forget, we can assist with Big and Smallâ finance from $5000 and upward including:

- All kinds of equipment, big and small

- Vehicles, Forklifts, trucks

- Solar and eco energy finance

- Property commercial and homes

3. Is now a good time?

If Interest rates are low why are property values softening and is now a good time to buy?

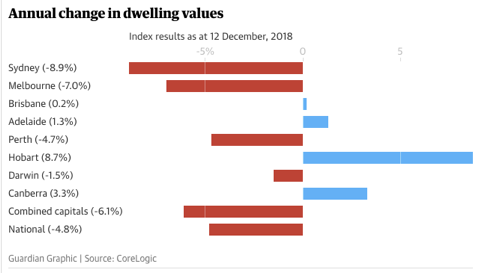

Interest rates are pretty good at the moment for borrowers and yet property values are softening. According to latest data, residential property values can be a bell weather indicator for property in general and as shown in the below table of Australian capital cities only Adelaide, Hobart and Canberra are bucking the trend with Sydney and Melbourne leading the charge south.

So the question is why? Clearly there are a number of contributing factors but a big one according to analysts is the fact that lending criteria has tightened significantly due to The Australian Prudential Regulation Authority (APRA) putting in place new guidelines in mid 2017 for lenders, such as reducing certain types of loans and reviews of service ability” criteria, i.e a borrowers capacity to service the debt.

Other things like rising construction in major cities such as Sydney and Melbourne has also created more supply with developers exposed to longer holding costs leading to reducing prices.

OK, so is now a good time to buy? The truth of the matter is that it doesn’t really matter what the market is doing, because you’re not buying the market. You are buying an individual property in the market, at the right price, so the key thing to remember is planning your purchase well.

Firstly, do your research on the right property/area etc. Secondly, don’t leave your financing to the end, start the conversation with your lender or broker ASAP. Here at Ecolease we have a team who can work with your Financial advisors and Accountants to ensure the best financing solution ahead of your actual purchase.